As a communication medium, SMS has been around for a while, let’s face it. It is almost as old as a cell phone. People are now genuinely at ease with it after it has been tried and tested, prodded and prodded.

However, many people fail to see SMS’s actual worth.

Although it can be simple to dismiss SMS as an antiquated technology, the truth is that it has never been more important in people’s lives—and, more importantly, in the lives of your consumers.

Since its launch, SMS has wowed us with remarkable user numbers (see below), open rates, and engagement levels that far outperform those of other communication channels.

It all begins with

For illustration, let’s look at how SMS has affected the financial sector. When you break it down, trust is one of the most important components that make up the finance business.

When selecting a financial institution for the first time, a prospective client’s decision-making process heavily relies on trust.

It should come as no surprise that research has shown that those under 25 who have had a great experience with a bank are more likely to utilize that same bank when they are ready to apply for a mortgage or other larger loan later in life. They are motivated to maintain their relationship with the bank because of this foundation of loyalty and trust, which is essential for any business.

What is the best approach for a company in the financial sector to establish trust?

By offering a quality product and even better SMS service, you can win people’s confidence and loyalty. Positive interactions with the bank will stick in people’s minds.

how it helped them and, in the end, how it made them feel. Building this shared connection should be a top priority when discussing the finance sector in particular, which is a sector of life that many people would want to completely avoid. It is, after all, the cornerstone upon which enduring relationships are built.

How do you accomplish this?

SMS is one of the most straightforward, dependable, and easy ways to accomplish this.

Companies frequently use SMS or text messages to create bridges that give clients a seamless, direct line of communication with their company. These bridges can be used to update clients on loan or credit applications, provide important account information, or simply remind clients of unpaid invoices. Building the rapport required for wholesome, long-term relationships is greatly aided by all of this.

Stopping Fraudulent Practices

Consumers who interact with financial institutions of any kind won’t require guarantees about the privacy, security, and safety of their information.

Financial organizations can provide their clients with SMS as a method to combat fraud. One approach to accomplish this is by implementing a two-factor verification system that provides clients with one-off passwords (OTPs) via their mobile devices.

Notifying clients when any strange activity appears to be occurring in their accounts is another.

All of these little actions add up to a certain comfort that helps financial firms not only attract but also retain clients.

Keep an eye on your servers via SMS

SMS can also be used to keep clients’ nerves calm by warning them of suspicious or unusual activities. In a similar vein, you may include SMS into your company’s internal operations to keep an eye on your systems and alert technicians to any issues with your digital infrastructure.

This will enable you to be informed of server problems immediately and make the necessary changes to address the problem.

Server monitor, an underutilized SMS service, can be extremely helpful for businesses that cannot afford platform outages.

Keeping Clients Updated

For many people, the EOFY can be an extremely stressful time.

Even the most composed people might become extremely anxious when they have to complete forms that involve significant amounts of money. Don’t worry. SMS is a simple way to inform your customers.

You can lessen the pain of what can frequently be a terrible process by updating clients on the status of their applications or alerting them when they might be due.

People’s lives are greatly improved by small things like these, which spare them a great deal of headaches, money, and precious time.

Past due

I mentioned this briefly above, but since a poor credit score can make someone’s financial future grim, it’s worth going into a little more detail.

In addition to lowering collection expenses associated with following up with late-paying clients who may be experiencing financial difficulties, employing SMS as a payment reminder may also spare an individual from the agony of having a negative impact on her credit score.

SMS outperforms email, direct mail, and phone calls as the most efficient method of reaching your clients, with an open rate of 97% and engagement levels into the 30s.

Compared to emails or phone conversations, how many SMS texts will you actually read? For this reason, SMS is the ideal way to send out urgent reminders.

Simple CRM Integration

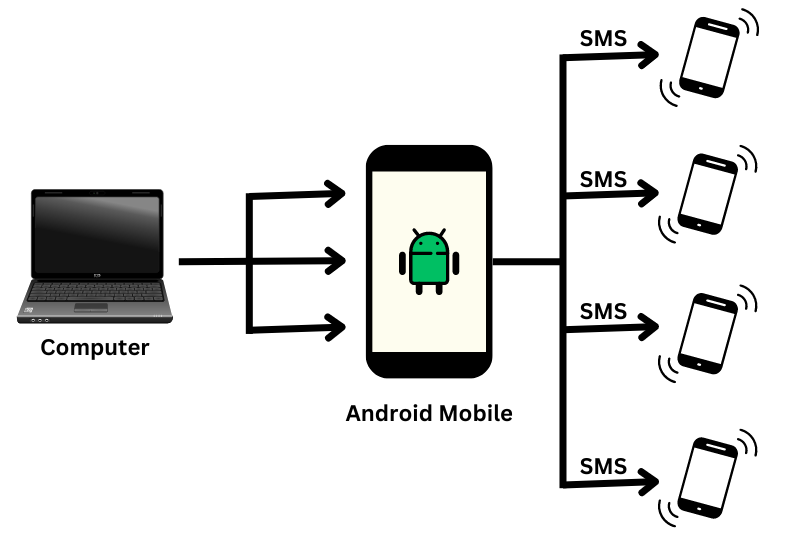

The good news is that it’s simple to get an SMS integration that benefits both you and your clients. For instance, SMSGlobal’s gateway connects directly to any internal apps that your employees use, enabling them to send important account information to clients in bulk if necessary. all customized using triggers and phrases.

Generally speaking, if it can send an email, it can also send an SMS. It’s that simple.

To learn more about how SMS can help your business, click the link below to get in touch with one of our helpful Customer Care agents. They would be pleased to provide you with additional information about how SMS can help your business.